Spotlight Collections

Collections of some of our best ideas and practical guidance

Turn here to see our Spotlight Series which highlights some of the most common issues family businesses encounter.

Spotlight Topics

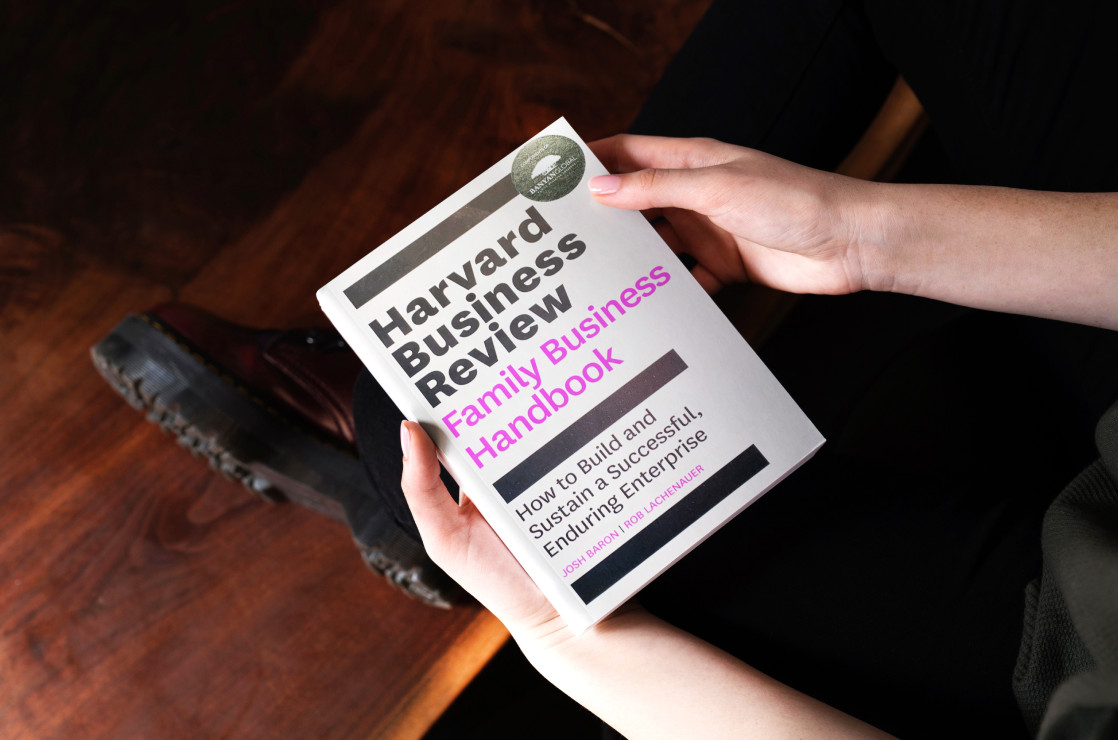

Harvard Business Review Family Business Handbook

Co-authors Josh Baron and Rob Lachenauer, founding partners of Banyan, share sophisticated guidance and practical advice for any family business owner, family member, or executive. The authors present proven methods and approaches for communicating effectively, managing conflict, building the right governance structures, and more.

The Harvard Business Review Family Business Handbook is a must-read for family business owners, family members, advisors, and employees. Easy (and dare I say fun!) to read, the authors mix great storytelling with actionable guidance and advice. Highly recommend!

Robert Pasin, CEO of 3rd generation family business Radio Flyer

Our People

Banyan Is Its People

“Banyan is a collection of smart, talented, and compassionate people. But what makes our team so special is our shared passion for helping the amazing family business owners we work with.”

Rob Lachenauer | Managing Partner