4 Ways to Prepare for Death in the Family

Summary: Death is difficult for any family. But for business families, the challenge is even more complicated. Business families have to deal with not only the loss of their loved ones, but also that loved one’s role in the family business (or business family). That’s the reason why it’s essential for family business owners to prepare and plan for the inevitability of death. In this excerpt from the Harvard Business Review Family Business Handbook, trust & estates attorney Dave McCabe shares his top tips for preparing for death in the business family: 1) Educate your family about the estate plan 2) Review and update your plan every two or three years 3) Make sure everyone understands the process and how it unfolds before they are immersed in it 4) Plan for consequences on the business, too

Expected or unexpected, death is difficult for any family. But for business families, there are added considerations. If a family business leader dies, for example, her son might simultaneously mourn the loss of his often-absent mother, his demanding boss who once fired him but also mentored him, a trustee who took care of him financially, a great philanthropist, and a loving grandmother to his children.

Family members may experience a range of feelings, including profound loss, guilt about things left unsaid or undone, freedom from controlling behavior, shame that they are wondering about the financial consequences of the death, and confusion on what may change in the future. These are all normal feelings in a business family.

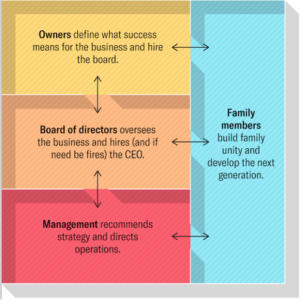

Even if you have developed sophisticated Four-Room governance the emotions from a death may prevent you and your family making personal and business decisions simultaneously as you mourn. Your carefully constructed boundaries can be at least temporarily overrun (“I haven’t seen Aunt Marcella since she fired me, but she’s at the wake!”). In some ways, the breakdown of barriers is appropriate so that you can remember and mourn the person’s life in its entirety. In other ways, the breakdown can be jarring at a time when you face major decisions.

During your grieving period for a loved one who has passed, when you are most vulnerable, you will face many unpleasant burdens. Funeral and burial arrangements are just the start. An Internal Revenue Service estate audit, new financial worries, loneliness, altered relationships, and other changes can swirl around you and the family business. Try to avoid making important decisions quickly during this time of mourning and change. You can easily make mistakes in your haze of grief. When Joe Robbie, then owner of the Miami Dolphins football franchise and Joe Robbie Stadium in Miami, died in 1990, his widow, Elizabeth Robbie, was unsatisfied with her annual income of $300,000 from the trust that held the family assets. To access more wealth quickly, she filed a petition of the trust that ultimately triggered a $47 million estate tax, which forced the family to sell its share of the Dolphins and the stadium at fire-sale prices. Elizabeth died within two years after triggering the sale. When the new owner resold these assets eighteen years later, it was widely reported that they were valued at more than seventeen times what the Robbie family had received.

During your grieving period for a loved one who has passed, when you are most vulnerable, you will face many unpleasant burdens. Funeral and burial arrangements are just the start. An Internal Revenue Service estate audit, new financial worries, loneliness, altered relationships, and other changes can swirl around you and the family business. Try to avoid making important decisions quickly during this time of mourning and change. You can easily make mistakes in your haze of grief. When Joe Robbie, then owner of the Miami Dolphins football franchise and Joe Robbie Stadium in Miami, died in 1990, his widow, Elizabeth Robbie, was unsatisfied with her annual income of $300,000 from the trust that held the family assets. To access more wealth quickly, she filed a petition of the trust that ultimately triggered a $47 million estate tax, which forced the family to sell its share of the Dolphins and the stadium at fire-sale prices. Elizabeth died within two years after triggering the sale. When the new owner resold these assets eighteen years later, it was widely reported that they were valued at more than seventeen times what the Robbie family had received.

Of course, preparing for death is disagreeable. Many business families avoid such preparation altogether. “When I’m dead,” one client bluntly told us, “I won’t care about the problems I leave behind.” We met a founder of an Asian financial services business in his late sixties who recently had experienced a significant health scare. He had no will, no estate plan, and no clarity on ownership after he passed. If he made no changes, within two years of his death, his heirs would need to pay the tax authorities an eye-popping sum –more than $400 million in inheritance tax, necessitating a fire sale of their business. That sale, especially during a time of grief, would probably have caused his children to lose both their business and their family relationships.

It’s tempting to avoid planning for your own (or your family patriarch’s or matriarch’s) death, but if you forgo this planning, you are quite likely dooming the business to failure in the long run. Is that what you really want?

“None of us want to recognize our mortality,” Dave McCabe, a highly regarded trusts and estates lawyer with Willkie Farr & Gallagher, told us. But failing to prepare creates the potential for chaos.

McCabe advises four basic steps to prepare for death in the family:

1. Educate your family about the estate plan.

One of the most common fears in the immediate aftermath of a family member’s death is that there won’t be enough money for the surviving spouse and family members to live on. “The anxiety around death and what happens next is enormous,” McCabe observes, “particularly if the surviving spouse has not really engaged with the finances of the family.” Make sure family members are aware of the specifics of your estate plan well in advance. McCabe, personally, has a binder with all his estate-planning documents prepared for his wife and children. The first three pages list each of the accounts (by the last four numbers) and a contact person at each institution. As the father of four daughters, McCabe makes sure that each of his children personally understands the details of the family estate. “They don’t need to know the dollars in every single account, but they do need to understand the scope of what’s there and how to access it.” Consider writing a letter of wishes, which is a non-binding indication of how you hope your trustees will administer your estate. Such preparation may be costly and emotionally difficult, but your heirs will praise your foresight as a lasting gift to them.

2. Review and update your plan every two or three years.

Big events in your life should cause you to reflect on the potential impact on your estate plan: you get married, get divorced, have children, or remarry; your children get married; someone in your family dies; and so on. Life events can change everything. Imagine, for example, that the last time you updated your estate plan, you were single and decided to leave everything to a charity. But you now have a spouse and two children whom, of course, you want to provide for. It’s easy to neglect these necessary updates to your estate plan, but the consequences can be significant.

3. Make sure everyone understands the process and how it unfolds before they are immersed in it.

Navigating the administrative process after death can be frightening. When are funds going to be available to the surviving family members? Finalizing an estate with tax authorities can take years. But that doesn’t mean surviving family won’t have access to funds until then. Explaining the process in advance reduces anxiety. McCabe’s firm provides clients with a one-page flow chart of how estate-planning documents work to make it easy for everyone to understand. Ask your estate-planning attorney to do something similar for you.

4. Plan for the consequences on the business, too.

Having an estate plan is not enough. You’ll want to plan for the transfer of the business, too. Make sure you have a well-considered ownership agreement that anticipates transfer of ownership at death. And have—and communicate—a succession plan. “You may leave everything to your spouse because that is tax-efficient,” McCabe explains, “but that doesn’t explain what to do about running the business. A very detailed plan is also important.”

*Adapted from the Harvard Business Review Family Business Handbook by Josh Baron and Rob Lachenauer. Pages 146-149.