Spotlight

Owner Strategy

One of the best things about being family business owners is that you get to decide for yourselves what you most value. But that doesn’t make defining value easy. There can be both financial and nonfinancial metrics of success. Determining how your family will define success requires your owner group to make some important decisions together about what matters most. Here’s how to think about the right Owner Strategy to guide both your business and your business family for years to come.

01.

Defining your Owner Strategy

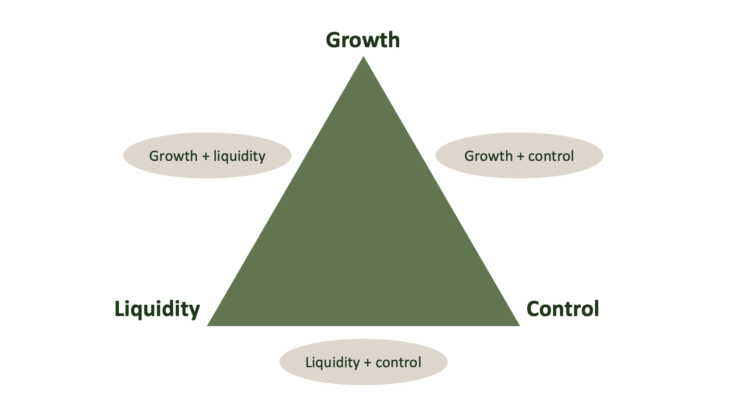

Growth, liquidity, or control? Determining how your family will define success requires a clear Owner Strategy to help you set priorities for your family business (and business family).

02.

Defining your Purpose

Why do you choose to own your business together with family members? If your family business is bound together only by a surface purpose, it’s unlikely to last in the long run. That’s why it’s essential to have a compelling purpose.

03.

Setting Owner Goals and Guardrails

How do you make decisions about trade-offs in how and where to create value? And then how can you ensure those running the business understand your priorities? With your Owner goals and guardrails.

04.

Crafting your Owner Strategy Statement

To capture what you value, owners should create an Owner Strategy statement, a document that articulates your purpose, goals, and guardrails, and can form the basis of a dialogue among owners, the board, and management.

05.

Philanthropy in Family Business

Giving back is a priority for most of the family businesses we know. Often, the most successful philanthropic efforts are part of your Owner Strategy, too.

Owners have the right to define what are the high-level financial and non-financial priorities for the businesses that they own together. When they are able to align and articulate those, it gives direction (goals) and limits (guardrails) for those making decisions on their behalf.

Vladimir Barbieri

Partner

Owner strategy conversations provide a special opportunity for family members within and across generations to share their goals and expectations. Working through differences can bring your family closer together and set a clear path forward.

Leigh Blank

Principal

Family business owners benefit from thinking like investors by answering a few questions: What are we trying to accomplish with this business? What are our financial and non-financial expectations? What risks are we willing to take? How will we measure performance against our expectations? Alignment on the answers to these questions allow a family to commit financial and non-financial resources to a shared vision of long-term success.

Ben Francois

Managing Partner

One of the best things about family ownership is that you don’t have to define success the way other companies might. You can follow your own path in determining what matters most to you and your family.

Rob Lachenauer

Co-Founder & Partner

Get our best ideas, practical guidance, and essential resources sent to your inbox.

Join Our Newsletter